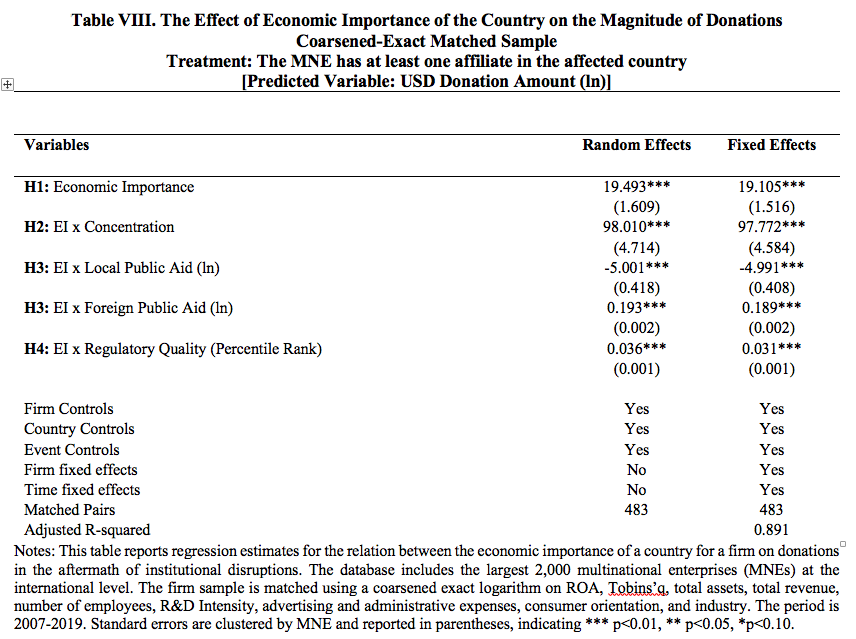

Coarsened-Exact Matched Sample

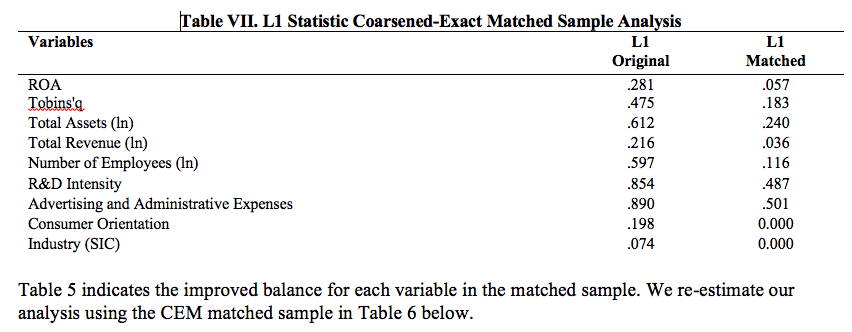

We applied coarsened exact matching (CEM) (Iacus et al. 2011) to balance the baseline propensity to donate between the treatment (i.e., firms with at least one affiliate in the affected country) and the control groups (i.e., firms with no affiliates in the affected country). The matching uses variables that the extant literature has identified as potential drivers of corporate philanthropy: ROA, Tobins’q, total assets, total revenue, number of employees, R&D Intensity, advertising and administrative expenses, consumer orientation, and industry.

We used no-replacement and targeted a treatment-to-control ratio of 1:10 but tested up to 1:2 for robustness. The L1 statistic, a comprehensive measure of imbalance between the treatment and control groups, is the sum of absolute differences across the multivariate histogram that has the following form:

where t_(li..lk)is the relative frequency of the categorical variables for the firms in the treatment group and c_(li..lk) is the corresponding number for the firms in the control group. A magnitude of L(t,c)=0 means perfect balance while a magnitude of 1 represents perfect separation.